ESG. Environmental, Social, and Governance a very important ideas in this quickly changing business and banking world we have going on. It’s so important now that businesses judge their practices and success with ESG approval. This blog will teach you all the things you need to know about it like what it means and what it could do to your job if anything at all related to best esg certification programs.

What is ESG?

ESG means measures that are good for the environment, people, and the government. This is a plan that companies use to figure out how their actions affect things like ethics, society, the environment, and the government. Let’s look more closely at each part of ESG,

- Environmental – The natural part of ESG looks at how a business affects the world around it. This includes things like carbon pollution, how trash is handled, dedication to green energy, and more.

- Social – The social part of ESG looks at how a business treats its workers, customers, and other important people. It also looks at policies for diversity and inclusion as well as following wage standards.

- Governance – Any company needs to have a good government. The governing part of ESG looks at how well a business follows its own rules and laws. The most important people are looked at to see how well they make decisions and behave ethically.

Table of contents

- What is ESG?

- Application of best ESG certification programs

- Best ESG certification programs

- ESG Certification Programs

- Examples of ESG Certification Programs

- What is an ESG Score?

- ESG Sheet

- Components of ESG Score

- ESG certification courses

- Top ESG Certification Courses

- Bloomberg ESG certification

- Benefits of Bloomberg ESG Certifications

- ESG reporting certification

- ESG training certification

- Tips for Choosing the Right Program

- Sustainability ESG certification

- Online ESG certification

Application of best ESG certification programs

ESG approval is essential for many fields including risk management, government, and banking. Hedge funds and investment management firms review ESG issues before committing to an investment. Judging a company’s long-term viability and ability to make money now includes taking into account its ESG policies.

Best ESG certification programs

Several certifications are available for professionals seeking expertise in ESG practices. Here are the top five certifications for best esg certification programs:

- CFA Institute Certification on ESG Investing.

- Global Reporting Initiative (GRI) Sustainability Reporting Certification.

- CDP’s Climate Change Course.

- RA Academy’s ESG Integration Course.

- International Association for System Economies Course.

All certifications educate you about ESG practices, but the CFA Institute Certification on ESG Investing teaches you so much more. This certification covers a lot about risk management and the effects of adopting ESG practices. The CFA ESG diploma will teach you new things and help you improve important skills. It is also designed to make people aware of the ESG megatrends (Environmental, Social, and Governance). With this license, you’ll be able to include ESG factors in the decisions you make every day for your business whether it is choosing investments or managing risks. We will share one of our well-wishers from Europe who has experience with getting an ESG certificate,

ESG Certification Programs

People who go through ESG licensing programs are given the information and skills they need to take ESG factors into account when making business decisions. The risks and possibilities businesses face have changed over time, making these programs more and more important ( According To, CFA Institute & Corporate Finance Institute ).

Examples of ESG Certification Programs

- ESG Certificate Program by Corporate Finance Institute (CFI): People who take this program will be ready for the pressures and demands of today’s businesses and stakeholders because it combines theory and practice in a shortened, self-paced way.

- Certificate in ESG Investing by CFA Institute: The information and skills in this certificate make it possible for people to think about ESG factors when making financial decisions.

What is an ESG Score?

An ESG score is a fair way to judge the success of a business, fund, or asset by looking at its Environmental, Social, and Governance (ESG) factors. The three things that are used to judge a company’s sustainability are its environmental impact, its social impact, and its governance ( Corporate Finance Institute & Finscience ).

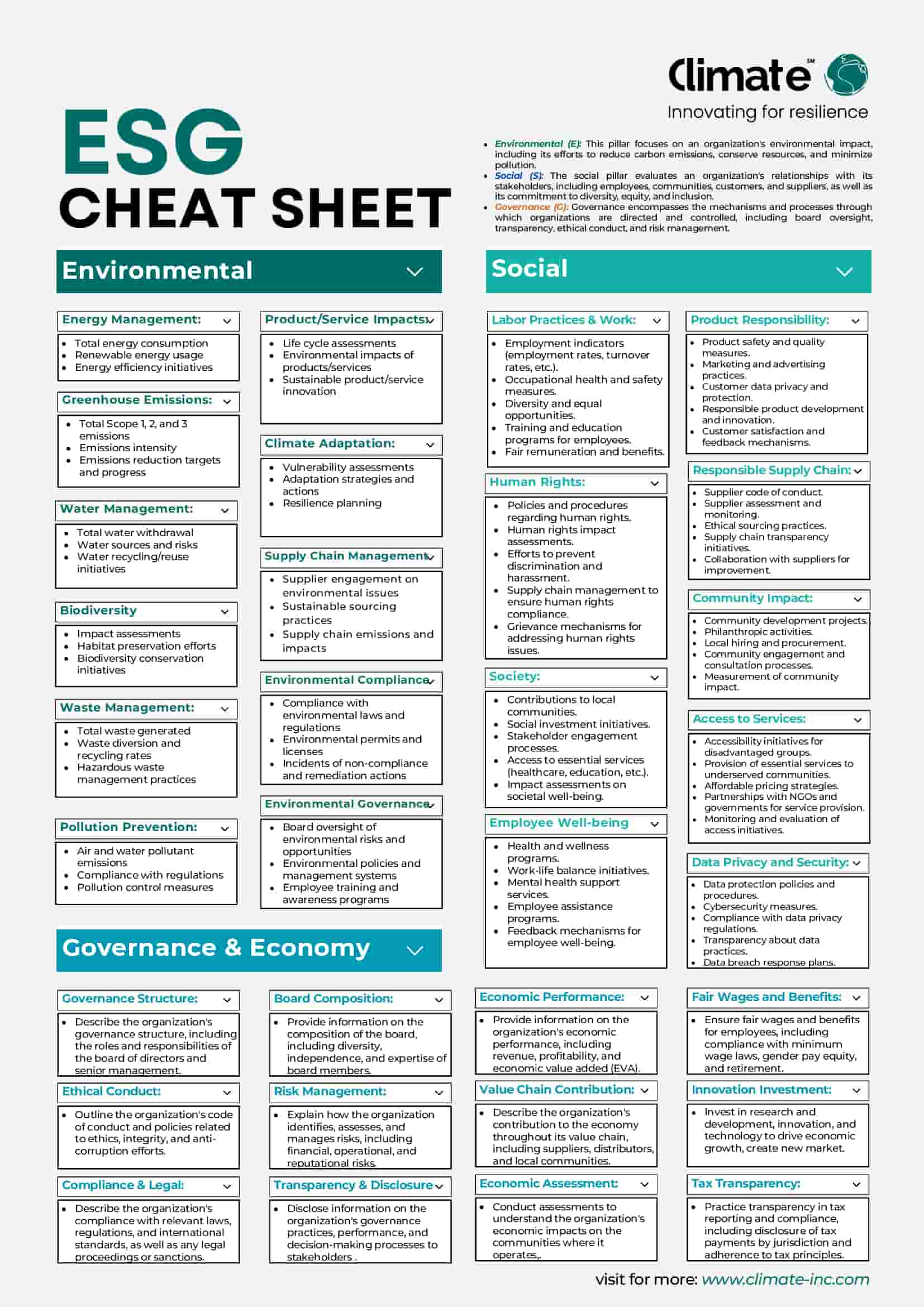

ESG Sheet

Components of ESG Score

The ESG score is divided into three main categories:

- Environmental Issues: This includes how much energy a company uses, how much water it uses, how much garbage it makes, how much trash it creates, and how it affects wildlife.

- Social Issues: This includes how the company treats its workers, protects human rights, builds communities, and makes sure customers are happy.

- Governance Issues: This includes the company’s governance, pay for executives, anti-corruption rules, and rights of shareholders.

The ESG number is important. You can use it to rate a business, a share, or even a fund. These grades help people make better decisions which helps them in the long run. In business, ESG codes and scores have always been important. They will tell people what they need to know to make smart decisions and help people figure out if a business will last. People think that as businesses change, this stuff will become even more popular.

Long Story Short, Here are some examples of companies that have high ESG scores:

- Microsoft: A software giant with an ESG score of 76.30.

- Linde plc: A specialty chemicals company with an ESG score of 76.00.

- Accenture: A tech services provider with an ESG score of 75.95.

- Nvidia: A chip innovator with an ESG score of 72.19.

- Adobe Inc.

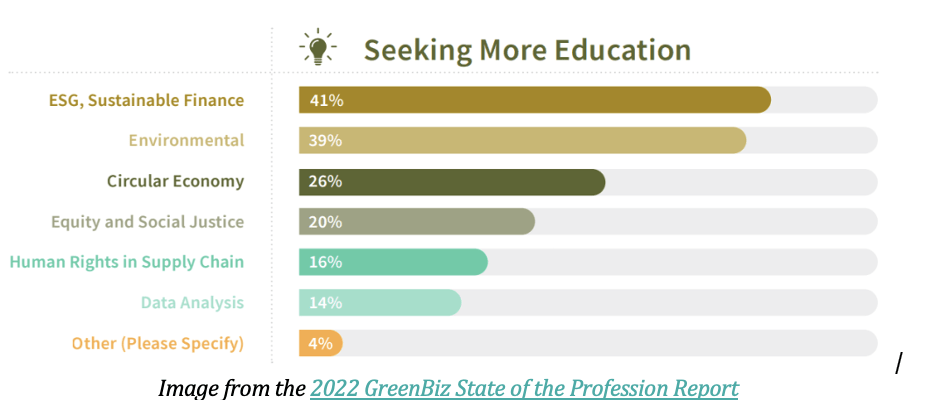

ESG certification courses

Also, in today’s business world ESG qualification classes are very important. It helps people judge if a company can survive and gives people the knowledge they need to make smart business choices. As the world of business changes, it is believed that ESG qualification classes will be even more important. Below I’ll go more into depth about our study with ESG Certification Programs.

Top ESG Certification Courses

- CFA Institute Certificate in ESG Investing – The CFA Institute offers a Certificate in ESG Investing. This program covers the context, analysis, valuation, and integration of ESG factors across different asset classes and investment mandates. The certificate is owned, administered, and awarded globally by the CFA Institute. The cost of the program is USD 865.001.

- Corporate Finance Institute (CFI) ESG Certificate Program – The Environmental, Social, and Governance program at the CFI teaches the most important skills to be successful in today’s fast-changing financial world. Theory and practice are taught uniquely in the ESG program, which has a shortened, self-paced curriculum. 13 classes in the school cover topics like business planning, reports, finances, and investments.

- Global Reporting Initiative (GRI) Sustainability Reporting Certification – The GRI Sustainability Reporting Certification is another popular ESG course. It provides a comprehensive understanding of sustainability reporting, including the process of reporting and how it can be used as a tool for stakeholder engagement.

- PRI Academy’s ESG Integration Course – The PRI Academy offers an ESG Integration Course. This class goes into great detail about how ESG factors can be used in the business process.

- International Association for Sustainable Economy (IASE) – The IASE offers a variety of ESG courses. These training sessions teach you everything you need to know about ESG factors and how they can be used in the business process.

Data analysis sources are – CFA Institute, Corporate Finance Institute

Bloomberg ESG certification

Bloomberg has many Environmental, Social, and Governance (ESG) licensing courses that are meant to give people the information and skills they need to think about ESG issues when making financial decisions.

Bloomberg ESG Certificate Courses are,

- Bloomberg Finance Fundamentals – This is an engaging, self-paced e-learning course called Bloomberg Finance Fundamentals (BFF) that teaches you the basics of finance and investing. The course looks at real-life situations from the points of view of different workers who work with money. It teaches students how to handle their money and how to make good money.

- Bloomberg Market Concepts – Bloomberg Market Concepts (BMC) is an e-learning course that’ll take you through a speedy and interactive trip around the financial markets using the all-powerful Bloomberg Terminal. You will learn about economic data, currencies, fixed income, stocks, commodities, stock options, and managing your wealth in this lesson.

- Bloomberg ESG Course – A self-paced course, Bloomberg ESG helps you learn how to create ESG strategies. You’ll also get the benefit of being able to prepare ESG reports for regulators as if you were working at a buy-side asset management firm.

Benefits of Bloomberg ESG Certifications

As our research, analysis, and experience say, Bloomberg’s e-learning certificate classes give students and young financial workers an edge by giving them the practical skills and real-life experience they need to compete and achieve. These courses provide industry-specific skills and experience, insight into real-life investment strategies, and exposure to the Bloomberg Terminal.

Data analysis sources are – Bloomberg

ESG reporting certification

As the energy industry shifts, customers and the larger industry are becoming more focused on sustainability, cutting carbon emissions, and reaching net-zero emissions. It will be important for companies to cover the key parts of ESG reports. More and more investors, buyers, workers, and even governmental bodies are asking businesses to be more open and responsible — making ESG reporting a must-do. Those who have a stake in these companies want to know how it impacts the world and if it’s committed to sustainability. It’s even been proposed that climate change information should be put on U.S. Securities and Exchange Commission (SEC) reports every year. Transparent reports let stakeholders see where a company is heading in terms of goals — even if they haven’t been reached yet. Companies can attract sustainable investors, make better choices, and add goods to society with ESG reports. Companies can also gain an upper hand in the market by being able to say that they have an ESG report license. Certification programs check if businesses follow reporting standards as well as ESG concepts. These licenses give independent confirmation of a company’s environmental efforts — making them more trustworthy in stakeholders’ eyes.

By getting an ESG report license, companies can show they’re committed to doing business responsibly which can get them ahead when it comes to attracting sustainable investments. And not only does this help businesses deal with the constant rule changes in reporting standards but also rules in general.

ESG training certification

How much does ESG certification cost? How can anyone become a qualified ESG consultant? How do you get to be an ESG analyst? Who needs to be ESG certified? Let’s quickly look at how the training program did in 2024. We paid close attention to how people use their training services. And here’s what we found when we shortlisted.

The top 10 best-reviewed ESG (Environmental, Social, and Governance) training certifications and coaching centers involve considering several key factors such as course content, accreditation, faculty expertise, and participant feedback.

- Yale School of Management.

- Overview: Yale offers executive education programs focused on sustainability, including ESG and sustainable finance.

- Why It Stands Out: Yale’s programs are known for their academic excellence and for bringing together leading experts in sustainability.

- Cambridge Institute for Sustainability Leadership (CISL)

- Overview: CISL offers a variety of sustainability leadership and business impact programs, including specialized courses on sustainable finance and ESG.

- Why It Stands Out: Affiliated with the University of Cambridge, CISL combines academic rigor with practical business insights, making its programs highly respected and impactful.

- ISSP (International Society of Sustainability Professionals) Certification

- Overview: The ISSP Sustainability Associate (ISSP-SA) and the ISSP Certified Sustainability Professional (ISSP-CSP) are the two levels of certification that cover all areas of business sustainability.

- Why It Stands Out: It’s one of the few programs that certify individual sustainability professionals, enhancing their credibility and career prospects in the sustainability field.

- SASB (Sustainability Accounting Standards Board) FSA Credential

- Overview: The FSA (Fundamentals of Sustainability Accounting) Credential is aimed at professionals who need to understand the financial impact of sustainability.

- Why It Stands Out: SASB standards are industry-specific and focus on financial material sustainability information, making this certification highly relevant for financial analysts and investors.

- GRI (Global Reporting Initiative) Certified Training Program

- Overview: GRI gives in-depth training on ESG reports and sustainability reporting, with a focus on the GRI Standards, which are the most popular sustainability reporting standards in the world.

- Why It Stands Out: GRI’s training is recognized globally, and completion of the program equips participants with the knowledge to produce robust and transparent ESG reports.

- CFA Institute Certificate in ESG Investing

- Overview: This certification is for people who work in the investment industry and teaches them how to look at ESG factors and use them in the investment process.

- Why It Stands Out: It’s offered by the CFA Institute, a globally recognized leader in investment education, ensuring high standards and industry relevance.

- CDP Climate Change Course: This course dives deep into the science, effects, and commerce-related issues of climate change.

- PRI Academy ESG Integration Course: This course is designed to help professionals integrate ESG factors into investment decisions.

- International Association for Sustainable Economy (IASE): IASE offers top-notch ESG certification and courses, providing comprehensive knowledge on sustainability analysis.

For some institutes, we were able to manage details and for some institutes, we are still updating our database. But the given results by us are accurate.

Tips for Choosing the Right Program

If you want a good education, look for classes that have been given a thumbs up by popular crowds. You’re going to want to make sure the course has ESG topics that you view as most important and match your career goals. Make sure you know how much the staff knows about ESG and ecological problems. A group of students that have a strong network in sustainability can do wonders for you finding new jobs and making connections. When looking at a school try and picture if it will work for you schedule-wise since some are only set up on certain dates.

Sustainability ESG certification

Environmental, social, and governance (ESG) approval and sustainability are becoming more important for banks. Making their businesses sustainable helps banks avoid legal and financial risks, make more money, and give a boost to their brand. Banks’ number one priority should be investing in sustainable finance so they can make money. In return, it’ll help them stay on good terms with the government and won’t interfere with social and environmental matters that could lead to massive financial risks. It was reported that If banks don’t invest in this then there is a chance that 50% to 60% of bank income will be lost. Another thing is that when they invest in sustainability it gives them new ways to make money. A study from the Business and Sustainable Development Commission says that the Sustainable Development Goals (SDGs) give businesses a chance to make $12 trillion. With all of these facts out there, banks can easily put their money into the businesses that want to take advantage of chances for healthy growth if they use Environmental, Social, and Governance (ESG) standards as rules for what they can look over possible purchases. The ESG criteria cover three main categories,

- Environmental criteria: This includes things like how much energy the company uses, how it handles waste, and how it treats animals.

- Social criteria: This category examines the employees’ working conditions and the company’s relationship with suppliers, customers, and the local community.

- Governance criteria: This looks at the company’s accounting transparency, risk management, audits, and shareholder rights.

When it comes to finding and using ESG factors in their lending choices, banks who join groups like the Principles for Responsible Investment (PRI) can find a lot of support. The PRI is all about making investments more responsible and sustainable. They’re made up of 2,000 foreign investors and banks. Banks that read the UN’s Environmental Programs Sustainable Finance Progress Reports can become thought leaders in the field of sustainable finance. These papers show all the latest possibilities and challenges in the industry so financial institutions can stay ahead of the curve.

Data analysis sources are – Global Impact Investing Network

Online ESG certification

We will answer the top 15 questions asking for an online ESG certification program. We picked the questions from CFA ESG certification. Other modules will be uploaded soon as per our reader’s engagement.

- The Objective of the Certification? Ans – The main objective of the online ESG certification is to analyze and integrate material ESG (Environmental, Social, and Governance) factors into investment decision-making.

- Content of the Certification? Ans – The certification is made up of nine parts, which are divided into three main groups. The first two parts explain what ESG and ESG markets are and how they work. From chapters 3 to 6, you’ll learn more about the ideas behind each ESG factor and why connection and care are so important. The last three chapters are all about how to look at ESG factors, put them together, and report on them. Three, seven, and eight are important parts to pay attention to because candidates have said they are the hardest.

- Entry Criteria? Ans – The online ESG certification does not have any requirements to get it, unlike many other qualifications. This means that anyone can apply, even if they have never invested before. This license can help people in consulting, risk management, wealth management, and other fields, though it may be easier for people who work in business.

- Target Audience? Ans – Investment workers are the main people who should get this license. But people who work in front- and back-office positions, like those in risk management, marketing, sales, distribution, fund management, and so on, can also benefit from getting this license.

- Cost of the Certification? Ans – Every day it’s different. However, the license costs $675, which covers both the test fee and the application fee. People who are applying can also buy the official book in PDF version for an extra $135 plus shipping. People who want to take the test again will have to pay $475 to do so. It’s important to remember that candidates have to let the CFA Institute know about any changes at least 72 hours before the test.

- Pass Rate and Pass Mark? Ans – About 60% of those who take the test are able to pass it. This test needs to be passed with a score between 60% and 70%. You should aim for a better score, preferably 70% to 75%, on your practice tests to improve your chances of doing well on the real test.

- Recommended Study Time? Ans – Whether you are a professional investor or not, the amount of time you should spend studying will vary. People who work in investments should study for the license for 100 hours, while people who don’t work in investments should study for 130 hours.

- Timeline for Exam Completion? Ans – Candidates have a full year to finish the test after they have applied. The test can be set up, though, as soon as prospects get proof that they have registered. The Certified Financial Analyst Institute says that people who want to take the test should study for at least one month. Of course, this is just an idea candidates can book the test whenever works best for them within a year.

- Edition Cycle Period? Ans – The third version, which is now out, will last until December 2022. After that, Edition 4 will start in January 2023, and Edition 5 will start in January 2024. It is important to note that the version cycle time has been changed to make the CFISG certification more in line with other Finance Commission programs.

- Booking the Exam? Ans -They can take their CFISG test as soon as they get proof that they have registered. You can go to a test center or take the test at home. During the week, test sites are open, and you can take the test from home from Monday through Saturday. Dates may not always be available, so candidates should look for choices that fit their needs.

- Global Availability? Ans – People all over the world already know about the CFISG certification, though it’s not yet offered in all areas. The CFA Institute is bringing the qualification slowly, one area at a time. To see if their country is on the list of open sites and in the description, candidates should read everything that is written there.

- Level of Difficulty? Ans – The CFISG certification is at Level 4, which is comparable to the IMC (Investment Management Certificate) Level 4. It is considered easier than the CFA Levels 1, 2, and 3, which are at Levels 5, 6, and 7, respectively. While the CFISG certification does not require complex calculations, it still follows the high standard set by the CFA Institute.

- Exam Preparation? Ans – Hard question it is. There is a PDF book and a practice test from the CFA Institute that you can use to learn. And many people want to find extra ways to study to help them get ready. Alma Mundus, a company that helps people prepare for tests, offers many learning materials. Some of these are free study tools, such as classes and practice tests. Some of them are paid study aids like question banks and fake tests.

- Discounts? Ans – To support candidates on their journey, Alma Mundus offers a 10% discount. Check the links provided below to access the discount code and take advantage of this offer.

- Is it Worth It? Ans – Another hard question. The online ESG qualification is well worth the money because it gives you information and chances. To meet the needs of clients who value ESG factors, investment experts must learn how to spend in the real world, including how to consider ESG factors. More and more countries are signing the UN Principles for Responsible Investment, and more and more assets are being managed in these areas. This shows how important and useful ESG information is. Professionals can get useful chances and stay ahead in the changing worlds of business and marketing by getting this license.

ESG certification for companies

The Environmental, Social, and Governance (ESG) approval process checks how committed a company is to responsible governance, social duty, and sustainable practices. By doing this businesses provide the world with a full picture of their effect on society and the environment around them. This is enough information for customers to make smart choices. ESG badges are good for more than just consumers too. They help workers reach their potential goals in sustainability and overall business growth. You see if you want to get ahead of your competitors these badges are what’s going to give you such an advantage in this very steep market. These values are driven by green certificates which check and report on how well companies follow ESG goals in their daily practices. A global reputation is huge because it puts an end to greenwashing and makes customers feel more comfortable investing in you as a company.

One well-known example of an ESG certification is the B Corp Certification, which is given by the charity B Lab and is recognized around the world as a mark of a company’s commitment to meeting the greatest standards of social and environmental performance.

Data analysis sources are – B Corporation, My ESG, and GreenBiz

The comparison and evaluation of the top ESG certification providers and courses

When thinking about ESG certification, it’s important to think about how holistic the program is, how well-known the service is, and how useful the certification is in real life. The CFA Institute’s Certificate in ESG Investing carries weight because of its tough program and global recognition. It covers a wide range of environmental, social, and governance (ESG) factors like extensive research and integrating ESG into operations. Professionals who work with sustainability reports, especially those related to social issues, might benefit from GRI’s license. It’s globally recognized as the standard for sustainability reporting. SGS’s ESG Certification is unique for environmental management because it isn’t an accredited certification scheme. It’s built on decades of research and audit data that make for a useful framework for ESG certification. The best companies offering them will have different methods of giving you each kind of license. For financial workers, you’d get one from the CFA Institute for sustainability reporting enthusiasts, you’d gravitate toward GRI, and for environmental management lovers, you’d go to SGS. Professionals should pick their licenses based on their job goals and what aspects of ESG they want to focus on. Each one makes you more marketable in your field while pushing us further toward a sustainable world economy.

Data analysis sources are – Know ESG, SGS

The emerging trends and best practices in ESG governance for 2024

In 2024, ESG governance continued to shift. Government mandates, social changes, and business strategy are moving all at once. We use the latest studies and reports to take a look at the new trends and best practices in ESG governance.

Anti-ESG Lawmaking and Regulatory Developments

An unusual trend in 2023 has been the rise of bills and votes that go against ESG. Over 150 anti-ESG bills and votes have been proposed in 37 states in the US this year alone. But most were either voted down or didn’t make it out of committee. However, by the end of the year, at least 40 rules against environmental, social, and governance principles had been passed in 18 states. People are becoming more polarized over ESG problems, making it harder for businesses to know how to approach these laws. Simultaneously, regulators — especially the Securities and Exchange Commission (SEC) — have been racing to write rules on ESG issues. The SEC’s focus on environmental, social, and especially climate-related statements and fund names underscores the importance of open and responsible disclosure when it comes to ESG reporting. These events show that businesses need to keep up with regulatory changes while ensuring their plans are still relevant.

The Role of Technology in ESG Governance

Enhancements in artificial intelligence (AI) and digital tools are crucial to improving ESG research. For example, AI can help fill in missing data and make ESG reports more accurate. The technology is even used to simplify pollution reporting of data such as Scope 3 carbon accounting and scan through a company’s ESG report so that decisions can be made faster. Changes like these allow businesses to take environmental, social, and governance practices from a legal requirement and turn them into strategic tools that drive smart decisions and resilience.

Supply Chain Transparency and Risk Management

The year 2023 brought with it a lot of climate-related disasters and tense political situations. These major events made one thing very clear: being open about the supply chain and handling risks within the ESG framework is very important. Companies are digging into their suppliers’ financial health, how they’re dealing with the climate problem, and working conditions more than ever before to lower risks and make sure they meet ESG standards.

ESG and Financial Performance

Business plans that only followed the rules and made report after report in the past are gone. Instead, individuals are realizing that good ESG performance and financial success go hand in hand. For instance, problems in the supply chain can hurt a company’s overall income. What this means is not having good ESG practices does come with some money issues.

Data analysis sources are – The Harvard Law School Forum on Corporate Governance and Thompson Reuters

We are at The Ending of Part

As usual, our utmost intention was to give everything possible and accurate information about ESG. We believe our writing will give enough support to know fully about the In-depth analysis of ESG. If yes please never late to know us.

Any further update is possible.