ESG is the new acronym that’s been floating around. Acronyms are usually pretty straightforward, but this one definitely isn’t. Environmental Social and Governance. It sounds a little more complicated when you say it in full, doesn’t it? Yet companies that can achieve a positive ESG stance have found ways to get a grip on various risks facing them today which reaps many benefits. Think of it as an indicator of performance skills and objectives that aren’t tied to monetary metrics.

ESG Risks

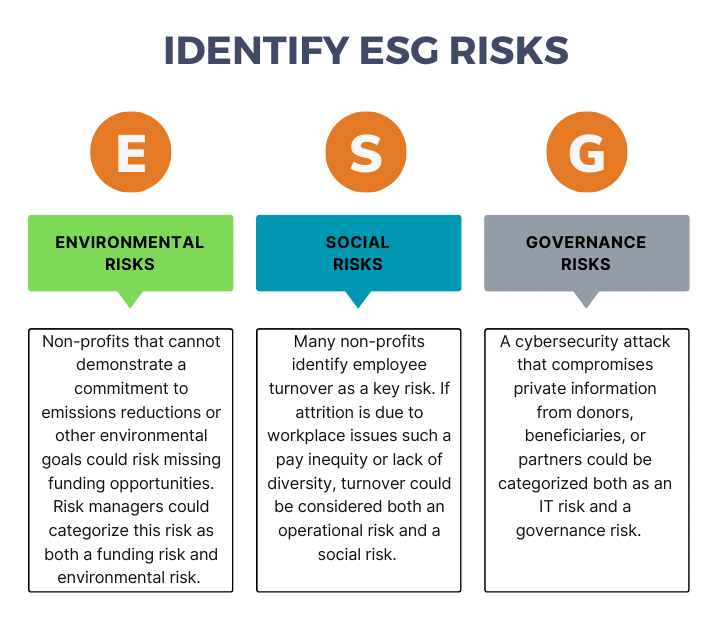

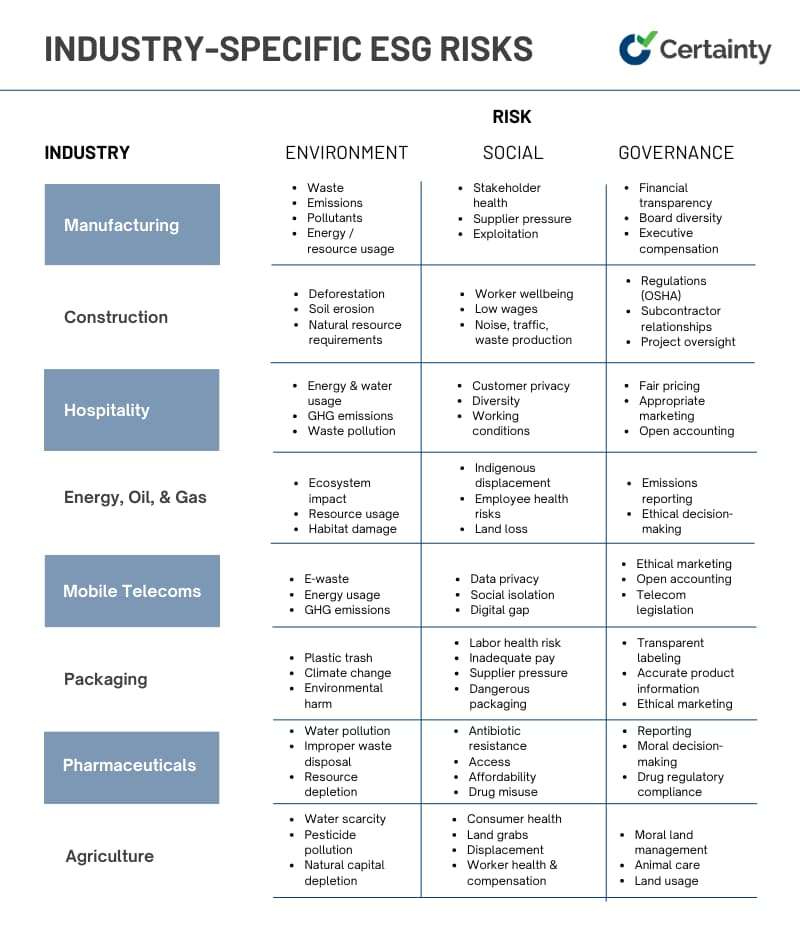

ESG risks can go left and right. For example, you have environmental issues like recycling, emissions, using too much of something, and how things are disposed of. Then you have social matters like worker rights, family leave, and what the employees are fed. Last but not least there are governance affairs like integrity in their work, and financial reporting responsibilities. In order to see how a company is at ESG and finding ways to better them involves looking at their data on internal operations and relationships with others that aren’t involved internally. We should not overlook some major facts about ESG risk management and also ESG risk certification in any way. And those are,

- Stakeholders – ESG is very important. Especially to the people who work for the company. Customers, employees, investors, business partners, and government regulators all want to know how the business takes care of its ESG responsibilities. They understand that with this knowledge they can tailor their relationship with the brand accordingly. Investors are always asking about risk mitigation efforts when dealing with any company so they can decide if their values align. A good ESG posture also makes sure your investment stays protected. Governments are following suit as well so getting ahead of this one would be pretty nice.

- Risk Management – ESG is fundamentally a form of risk management. Part of what people in this field do is assess a company, monitor its ESG metrics, address problems, and report on findings. First, identify the specific risks associated with a particular industry or company. Regulatory risks such as emissions reporting requirements and permits as well as exposure to lawsuits. Technological risks that come from the failure to adopt newer more efficient technologies and tools. Market risks include things like the cost of raw materials going up or down or new companies joining the market.

- Opportunities – Now, we need to respond to the risks from before. This can be done by finding opportunities. For instance, moving to more energy-efficient sources and simplifying your business cuts down on your carbon footprint and helps you stay in line with environmental laws. By making new goods, services, and business methods, companies are responding to changing market needs. Expanding your supplier base and accessing new markets to diversify the organization

- Benefits of ESG Compliance – The cost of keeping an eye on and making sure that ESG rules are followed may seem high, but remember that ignoring these risks can have very bad results.

- Examples of Disasters – Some recent examples of these disasters include the BP Deepwater Horizon oil spill, costing the company $65 billion, Michigan’s water crisis, costing the state $600 million, and Volkswagen’s hidden toxic diesel emissions which resulted in a charge of 31.3 billion euros. Don’t end up like these companies or their investors. Do something about ESG compliance right now to make sure you only work with companies that share your values.

More in-depth disaster analysis of our team are,

- Environmental disasters – In 2010, the BP Deepwater Horizon oil spill flooded water in the Gulf of Mexico. That one event caused so much damage to the environment and cost BP over $65 billion to fix it. The climate change we’re seeing today directly links to these oopsies. It’s raising the frequency and severity of extreme weather events like floods, hurricanes, heatwaves, and wildfires which all then cause more economic damage. One example is in America where a wildfire in 2020 gave over $7 billion worth of insured losses alone.

- Social disasters – The Flint water crisis which began in 2014 exposed residents to toxic levels of lead and could end up costing $1.5 billion to fix. Poor cybersecurity or privacy protections can put consumer data at risk or result in breaches of privacy causing reputational damage, legal penalties, and financial losses.

- Governance disasters – Scandals related to executive compensation, political lobbying, bribery, and corruption can damage a company’s reputation and investor confidence.

Understanding ESG risk management framework with S & P Global Market Intelligence

The paper finds major disagreements between rating agencies in their ESG assessments of companies. Specifically:

- There is a large divergence across agencies, with correlations of ESG ratings ranging from 0.54 to 0.71 between agency pairs.

- 56% of the divergence is attributed to measurement differences in how raters assess specific ESG categories.

- 38% stems from differences in scope, i.e. which ESG categories each agency considers.

- Only 6% is due to explicit weight differences in how agencies combine category scores.

Another obstacle is the apparent “rater effect,” where agencies consistently show a tendency to be more optimistic or pessimistic, skewing their measurement of individual ESG categories. For example, a rater with an optimistic view of a company may rate specific ESG aspects like carbon emissions or board diversity higher than warranted by the underlying data.

This lack of objectivity and potential bias in translating data into ESG ratings calls the credibility of those scores into question. The divergence across major agencies also makes it difficult for asset managers and companies to benchmark ESG performance. And it reduces accountability companies can more easily shrug off poor scores from one agency by pointing to better ratings elsewhere. Biased and subjective ratings risk undermining the goal of directing capital toward ethical practices and managing exposure to ESG risks.

The Understanding of ESG Risk Management Framework with Rep Risk

The importance of ESG data is immeasurable in today’s digital world. Companies have to deal with many risks that could affect their finances, reputation, and sustainability. This is where Rep Risk comes in – they provide useful insights and solutions that help companies manage the complexity of ESG risk.

Rep Risk is a valuable ESG data science company providing qualitative and quantitative research for its clients. Their data sets primarily focus on making companies understand responsibilities, misconducts, and risk management in ESG. One unique thing about Rep Risk’s methodology is its “outside-in” approach to research. They only use publicly available data to ensure transparency and accuracy.

Combining AI technology with machine learning and human intelligence allows Rep Risk to offer clients speed, scale, and quality assurance in their data sets. The best part is that it’s changed every day. It provides great insights into 100 ESG categories for both infrastructure projects and companies alike.

Regulations are always changing and as time progresses the focus on ESG risk increases. It stands for Environmental, Social, and Governance Risk, in case you haven’t heard of it. The company Rep Risk has identified a few key industry themes that shape discussions among their clients. These include Supply Chain Due Diligence, Climate-Related Risk Management, and Human Rights Abuses.

Some private equity firms are investing in advanced pre-investment due diligence processes to enhance decision-making and investor reporting, according to Rep Risk’s latest announcement. Consultancies and technology vendors will need solutions to address regulatory requirements such as SFDR (sustainable finance disclosure regulation) and the German Supply Chain Act while also addressing principles and ensuring due diligence.

But Rep Risk is looking to innovate even more by enhancing its products so it can keep up with emerging trends in the ESG data space. One notable enhancement is their geospatial analytics which helps identify proximity-related risks for infrastructure projects near sensitive sites and protected areas.

The advancement aligns with evolving regulations like the Task Force on Nature-Related Financial Disclosures (TNFD), highlighting the importance of nature and physical risk activities.

Importance of ESG Risk

For both financial services and corporate organizations ESG risk assessment is crucial. It’s driven by factors like investor reporting, societal pressures, internal policies, and external regulations. Adding complexity are indirect risks and third-party relationships, making data and technology essential for transparent risk management processes.

Ultimately, the goal is responsible business conduct for companies. And integrating ESG risk assessment into strategic goals is imperative for long-term success.

MetricStream’s Offerings for ESG Risk Assessment

Managing the needs of ESG (environmental, social, governance) reporting frameworks is a task that MetricStream specializes in. Companies often need to juggle multiple frameworks like GRI, SASB, and TCFD. From that point on it’s all about collecting data and automating processes to make life easier for corporations. This information can include everything from assessing operations to sourcing materials to determine where they stand on ESG risks. As the cherry on top, MetricStream also provides AI-powered solutions to put these risks into perspective.

The platform can even give you real-time quantifications on how bad things could get if left unattended. With this kind of control over ESG reports companies will finally be able to evaluate the impact of any ESG risks in relation to their investments.

We’re not done yet though. To ensure enterprise customers are getting everything they need MetricStream offers integrated risk intelligence features as well. This rigorously evaluates how bad other potential pitfalls can become given the situation at hand. It’s all part of building trust with everyone involved and minimizing damage wherever possible while maximizing strength through good policies and performance.

ESG risk framework you should know in 2024

ESG investing is catching on like wildfire. Investors are demanding more from the organizations they invest in than ever before. They want transparency and accurate, timely reporting. You’ll find a number of ESG reporting frameworks out there that companies can report to. There is a lot to choose from but we will be diving into 5 of the most common ones: GRI, CDP, TCFD, SASB, and CSRD.

- The Global Reporting Initiative (GRI) – GRI, the Global Reporting Initiative – is a non-profit organization that makes it possible for practically anyone to report their environmental impact. GRI works for corporations and governments just as effectively as for other types of organizations. This has become the worldwide reference standard with 73% percent of the top 250 companies like GRI. The principles are applicable to all people and free of charge if you want them. Also, it covers economic, ecological, and social areas in detail. Anything along these lines would be shocking if they couldn’t help you with whatever challenges are bothering your mind at the moment.

- The Carbon Disclosure Project (CDP) – The CDP is a worldwide non-profit group that was started in 2002. It used to be called the Carbon Disclosure Project (CDP). They’re all about running an environmental disclosure system that’s global for investors, companies, cities, states, and regions. The whole deal with CDP lets organizations report under three different main focuses: Climate Change, Forests, and Water Security. In 2015, they also created a well-known GHG-modelled emissions data set that gets quality-reviewed. This model helps assess carbon risk for companies and investor portfolios. A scoring mechanism comes along with their service on top of the system for disclosure. This score is based on the level of company action and depth of disclosure given by the people using it. Once a year they round up those who got an A-List spot — recognizing them as an organization that leads in transparency & sustainability efforts.

- The Task Force on Climate-Related Financial Disclosures (TCFD) – The Financial Stability Board (FSB) created the Task Force on Climate-Related Financial Disclosures (TCFD) in 2015. It’s meant to help buyers figure out what climate risks businesses face so they can choose wisely. The organization even developed a method for four thematic areas of communication: Governance, Strategy, Risk Management, and Metrics & Targets.

- The Sustainability Accounting Standards Board (SASB) – The Sustainable Accounting Standards Board, or SASB, is a non-profit group whose goal is to give buyers world rules on how to read sustainable information. These standards are meant to tie together businesses and investors by showing them the financial impacts caused by sustainability issues. They offer rules that fit into 77 industries across 11 categories. A list of these standards comes up with 30 items that could impact an organization’s finance within five major themes “Environment”, “Social Capital”, “Human Capital”, “Business Model & Innovation” plus “Leadership and Governance.”

- The EU’s Corporate Sustainability Reporting Directive (CSRD) – The Corporate Sustainability Reporting Directive (CSRD) is the next step forward for ESG reporting for companies in the EU. The European Sustainability Reporting Standards (ESRS) will tell businesses what they need to include in their reports. Sector-agnostic standards that apply to all eligible companies no matter their industry are pushed through these rules. Some of the things that companies have to say are general disclosures, environmental disclosures, governance disclosures, and sustainability disclosures.

COSO ESG framework

COSO, otherwise known as the “Committee of Sponsoring Organizations of the Treadway Commission,” recently revealed that they will be partnering with NACD, also called the “National Association of Corporate Directors,” in order to develop a brand new guidance and corporate governance framework. There was a group called COSO in 1985 that helped the National Commission on Fraudulent Financial Reporting. Their objective was to learn more about fraudulent financial reporting and how it affects companies. They then took their findings and developed recommendations for public companies, auditors, regulators, and educational institutions.

The key things to know about COSO are,

- It was formed to sponsor research into financial fraud and develop recommendations to prevent such fraud.

- The original sponsoring organizations were five major US professional associations related to accounting and financial management.

- It operates independently from its sponsoring organizations.

- Recently, COSO announced it is working with NACD on developing improved corporate governance standards and guidance. This demonstrates COSO’s continuing commitment to preventing financial malpractice through better governance and controls.

COSO is an independent organization that mainly focuses on the integrity of financial reporting and preventing fraud. They are now putting all their efforts into a project aimed at improving corporate governance frameworks and application guidance.

Below you will find key details about the request for proposal (RFP) issued by COSO and NACD, to create a new Corporate Governance Framework (CGF). Organizations of all kinds and forms will be able to use this system to get advice based on principles. The guidance provided will allow them to build effective governance practices.

Key Dates,

- Notice of Intent to Respond Due February 20, 2024

- Proposals Due: April 1, 2024

- Expected Project Completion: June 30, 2025

Intended Users,

- Public companies for self-assessment and enhancing governance

- Startups for building governance practices

- Private companies for best practices or IPO readiness

- Auditors, agencies, and investors for assessing governance

The goal is to create a widely adopted framework, similar to COSO’s internal control and enterprise risk management frameworks, that establishes guidance and standards for overall corporate governance.

ESG risk mitigation by protecting your business from Greenwashing

In today’s business world, ESG reasons are a critical variable influencing corporate reputation and the way investors view things. As companies compete to show how dedicated they are to sustainability and ethical practices, there comes the risk of greenwashing. This happens when a company fools everyone by overstating (or just misrepresenting) the environmental impact it has. And this has become quite an annoyance lately. One of the things that regulatory bodies like ASIC have put on their priority list is attacking greenwashing by looking into everything a company does or says. From their website down to product disclosure statements, if something looks off about how sustainable or inaccurate a claim is, ASIC will be taking action against that company. ASIC has been hitting hard in recent years in the current financial year, 35 actions were taken for misleading disclosures related to greenwashing alone. These actions range from requesting correctional disclosures to civil penalty proceedings against stubborn companies who refuse to do so. As growing awareness surrounding these risks spreads throughout businesses more and more are adopting a tactic known as “green hushing”. Instead of overstating claims around what good they’ve done or are doing for nature and society, they instead underplay these claims or even leave them out altogether. While this may prevent overstatement, it also stops us from recognizing many genuine efforts aimed at helping out society and our planet in general.

As the ASIC continues to crack down on greenwashing practices, businesses are being told to be super cautious in their ESG disclosures. Every single thing that they put out there will need a good vetting to make sure it’s accurate and compliant with all the standards requested of them by the regulators. If they don’t do this, it can have dire consequences for them. Leaving not only their reputations damaged but it could also force them into financial liabilities.

What analysts say about Risk Management and ESG

The challenges that ESG presents are difficult to handle, and these issues are all linked together. Firms have trouble figuring out how to get through them because of this. However, by using risk management as a framework, companies can get a better idea of their exposure to ESG and the opportunities it provides. It wasn’t a big deal before, but now it’s one of the most important things.

Tools and Techniques Professionals who work in the environment, social, and governance spaces have been asked to be more diligent with their work. This course helps you make your approach to ESG much better. Our goal is for you to use risk management, identify risks and opportunities, and monitor ESG.

Building Sustainability and Resilience Building sustainability and resilience within an organization is one of this course’s key focuses. It is crucial for companies to understand and manage ESG risks so that they can be ready for the challenges ahead. This is where the process of managing risk comes in. Moving through identification, assessment, mitigation, and monitoring is what makes this process crucial.

Many professionals from a range of industries will come out the other end of learning how to make ESG part of their day-to-day work with a pretty benefit. They will learn how to help their companies move forward sustainably and responsibly by understanding the complexities of ESG issues and using risk management techniques.

What do Environmental, Social, and Governance (ESG) have to do with Enterprise Risk Management (ERM)?

Environmental, Social, and Governance (ESG) issues have grown in importance for companies over the past few years. We need to take it one step at a time. If not, it might make things more complicated.

Understanding ESG Considerations There are many factors to take into consideration, some of which include climate change, natural resource depletion, labor practices, human rights, and board diversity. Those things will have a big effect on a company’s bottom line and its image. Investors along with customers and the community will now look into these ESG practices as a means to assess their long-term viability.

The Role of ERM in Managing Risks Risks are everywhere, but businesses can make or break what they’re building. This is the reason for Enterprise Risk Management (ERM). To put it simply, ERM helps find, evaluate, and handle risks. While that’s great and all it doesn’t really mean much when it’s not applied to anything specific. So let’s see something more applicable: By incorporating environmental, social, and corporate governance (ESG) considerations into their ERM framework, organizations can better understand and manage the risks associated with ESG factors. Better yet, this approach can help companies meet changing regulatory requirements as well as stakeholder expectations ultimately creating long-term value for stakeholders and the community along with it.

The Challenges of Incorporating ESG into ERM It’s difficult to incorporate ESG considerations into ERM. Because it’s complicated and has many sides. It takes time and money for businesses to do this. By analyzing data, identifying risks, and properly assessing each ESG factor. Not only that but how companies use these factors can differ dramatically based on their business.

ERM and ESG considerations are both vital when it comes to managing risk and creating value in the long term. With the integration of ESG in a company’s ERM framework businesses can comprehend what steps they need to take when it comes to managing risk. For all this to happen however they’ll have to tailor their approach depending on each organization’s specific needs.

Upcoming Guidelines and Implementation of ESG Risk Management Framework

Environmental, social, and governance (ESG) factors are becoming increasingly important for financial institutions in today’s rapidly changing financial landscape. The European Banking Authority (EBA) has put out new rules on ESG risk management to help businesses find their way around this tricky area. The guidelines set out what ESG risk management consists of and what an institution must do to identify, manage, measure, and monitor the risks. One crucial element highlighted by the EBA is “the need to conduct a materiality analysis of risks with a focus on data quality and systematization”. But identifying ESG-related risks is not enough. Firms have to integrate them into their overall risk management. This includes their strategy, business plans, risk appetite, and culture towards risk.

Institutions should also formulate credible transition plans that deal with the risks associated with transitioning to regulatory objectives related to ESG within their jurisdictions. The rules should be complete by the end of 2024. They will then serve as a roadmap for enhancing institutions’ practices as well as adapting to evolving regulations in this field.

ESG Country Monitor

As businesses navigate the ever-changing landscape of environmental, social, and governance (ESG) metrics, the need for credible and meaningful assessments is becoming increasingly important. With public scrutiny, reporting obligations, and stakeholder demands on the rise, organizations must find ways to effectively assess and manage their ESG exposure across global portfolios and value chains.

Control Risks’ ESG Country Monitor offers a comprehensive solution to help businesses map their exposure to sector-specific ESG risks across jurisdictions worldwide. By providing a clear view of potential exposures, organizations can better understand the impact on their strategies, investments, compliance, and sustainability efforts. Control Risks’ ESG Country Monitor has got some of its analysts, who have extensive knowledge of local environments. It is due to this kind of expertise that they can give meaningful insights and data that can support pre-investment decisions, supply chain risk screening, sustainability reporting, and others. Through a combination of country-specific political, operational, and regulatory risk expertise with globally aligned ESG reporting standards, organizations have access to analytical and objective data points for monitoring and identifying ESG risk levels across value chains. Their trend assessments indicate whether the risk environment is worsening, improving, or stable thereby helping businesses stay ahead of emerging risks.

Having over 100 country analysts worldwide Control Risks’ ESG Country Monitor offers the context and insights needed to measure, monitor, and manage material ESG exposure effectively. For example, by leveraging their methodology firms can optimize their ESG strategies as well as enhance their risk management practices.

ESG Risk Management Framework Based on AI and Machine Learning

Environmental, Social, and Governance (ESG) issues have been taken into account more when investing in the past few years. People are now putting their money into companies that are better for the environment and society. It has also been shown that in the long run, companies with good ESG standards do better than their competitors.

Artificial Intelligence (AI) and Machine Learning (ML) are very powerful tools that have already revolutionized many sectors, including ESG investing. Instead of using human analysts, which is slower and less accurate, AI can quickly gather massive amounts of data related to ESG such as emissions reports, labor practices, or board diversity statistics. It’s even capable of making sense of complex, unstructured data that humans could never.

Patterns in data sets can be used by machine learning models to guess what will happen or what trends will happen in the future. This is especially useful for ESG investing where it’s hard to predict how well a company will perform in the future based on their ESG score alone. If there was a potential regulatory change coming up that would affect a company’s score negatively ML could find this information before human analysis even finished reading the report. By analyzing ESG data these technologies can also help investors identify risks associated with a specific company by calculating the probability of a negative event happening such as an environmental disaster or social unrest caused by governance scandals.

Real-world Examples Arabesque S-Ray and Datamaran are tools that use AI and ML to rate the ESG success of businesses. They collect data from multiple sources, apply machine learning algorithms to identify patterns and generate ESG scores that can be used to guide investment decisions.

As AI and machine learning get better and more people use them, we can expect more advanced tools to be made for collecting, analyzing, and judging stakeholder risk. Natural Language Processing (NLP), for instance, could be added to these tools to give useful information about how people feel about a company’s ESG practices. AI has the potential to make ESG investing a lot more transparent so investors can have access to reliable and up-to-date information.

AI integration will also introduce many ethical considerations because, with its advanced capabilities, it’s possible for bias in AI and ML algorithms to occur without conscious intention. To avoid this from happening companies will need to ensure they’re using it with good intentions by making sure their use aligns with ESG principles.

We can really change the way ESG trading is done by using AI and ML. This gives us powerful new tools for gathering data, analyzing it, and figuring out how risky something is. Not only will it help us make better choices, but it will also help those who need it the most. When AI, machine learning, and ESG investments come together, they will continue to make good changes in society and the environment.

More Resources for our readers for further insights about ESG risk assessment

All the information we gather and collect are the most accurate and proven details. We highly encourage our readers to encourage their minds to gain further analysis. On behalf of that, we are embedding a recently updated 2024 webinar with the engagement of Chief Impact Officer, Dr. Tim Siegenbeek van Heukelom Mike Hower (Founder at Hower Impact), and Nidhi Chadda (CEO at Enzo Advisors).

We are the Ending Part of this session

Long story short, Be with us with your valuable time of reading and sharing our intels. Sayings say that Sharing is caring.

Will see you in the next writing.